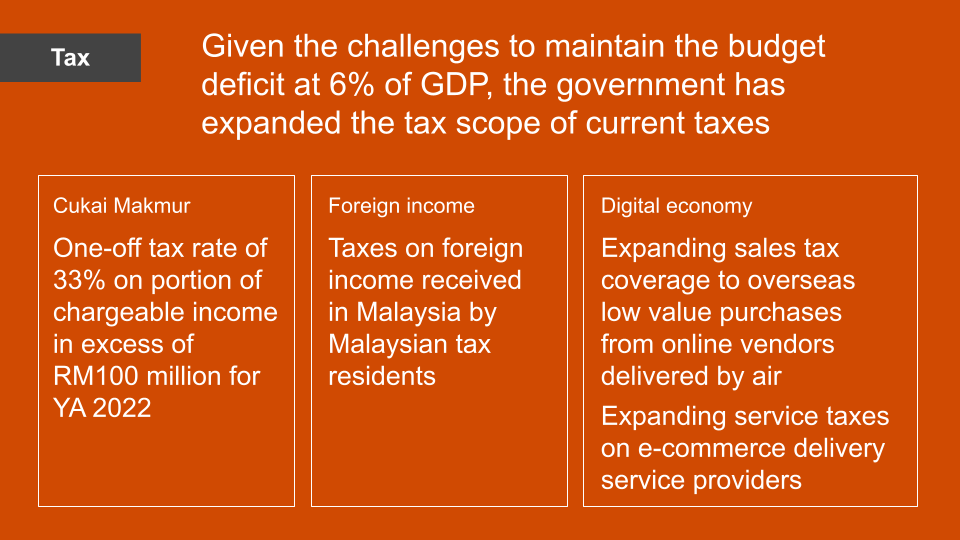

The 5th IMF-Japan High-Level Tax Conference for Asian Countries Latest tax policy reform in Malaysia. On subsequent chargeable income.

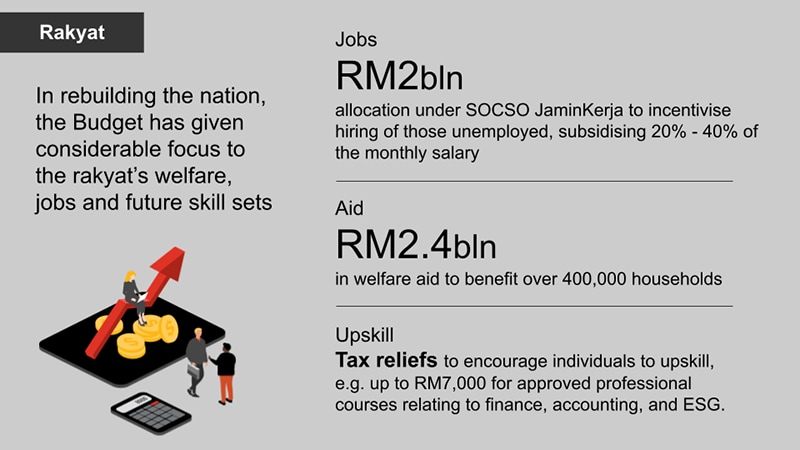

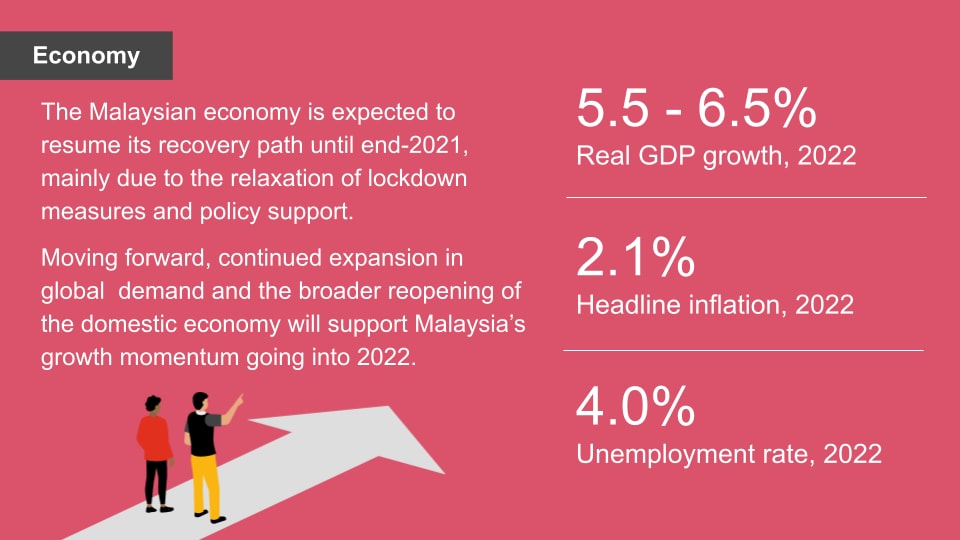

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

If your income is earned in Malaysia it is liable for.

. 42020Service tax on online distance learning services. A company carrying on a business is resident in Malaysia if its management and control is exercised. Double Taxation Relief Malaysia.

OECD Tax Policy Overview of CGT. The amended service tax policies concern. Malaysia is divided into 13 states and three federal territories with Kuala Lumpur as.

Hence income tax in Malaysia is territorial except for the specifically mentioned sectors. The amount of tax payable for the year must be self-computed and the tax return is deemed to be a notice of assessment. It has been previously reported that only 21 of registered companies in Malaysia are subject to income tax and only about 15 of the labour force is paying individual income tax.

By Farah Dhiba Binti Ahmed. Ministry of Finance Malaysia. Malaysias taxes are assessed on a current year basis and are under the self-assessment system for all taxpayers.

Under the MM2H visa expats are not required to pay tax on their income no matter where it comes from as long as its remitted from overseas. EYs global tax policy network has extensive experience engaging with companies and governments on the development and implementation of policy initiatives. West Malaysia and the Malaysia Borneo region bordering Indonesia and Brunei ie.

The deadline for filing income tax in Malaysia also varies according to what type of form you are filing. Malaysias Roadmap Towards Zero Single-Use Plastics 2018-2030 The vision of this Roadmap is to take a phased evidence-based and holistic approach by. 12020Expanded scope of taxable service.

That said income of any person other than a resident company carrying on the business of banking insurance or sea or air transport derived from. On the first RM 600000 chargeable income. Read More National Policy on Industry 40 Industry4WRD.

32020Service tax policy on claiming a refund under the offsetting method with regard to service tax on imported digital service provided by foreign registered persons. Latest tax policy reform in Malaysia. Amendment to Service Tax Policy No.

This is a challenge for the government when trying to extract tax revenue. From the year of assessment beginning 1 January 1975. From the income year beginning 1 April 1974.

Malaysia has put in place the National Policy on Industry 40 Industry4WRD that provides a concerted and comprehensi. The Peninsula Malaysia region bordering Thailand ie. One key problem with the Malaysian tax system is the narrow tax base.

Subject to meeting conditions Service Tax exemption on imported taxable services for companies in Labuan effective 1 September 2019 is now extended to 31 December 2021. Therefore this study provides tax policymakers information for future tax reforms in Malaysia. GST Relief on Construction Services for School Building and Places of Worship.

Self-assessment for individuals. Tax 02 January 2018. Service Tax is exempted for services occurring on 31 December 2021 and ending 1 January 2022.

Contact Us Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya Hotline. Assessment of the corporate tax burden on existing capital is particularly relevant to tax policy questions concerning equity and neutrality in the tax system with the aim of analyzing investment incentives and related tax policy Wagnon 2004. Amendment On Real Property Gains Tax.

This includes interest earned on income sitting in accounts in Malaysia. Given Malaysias reliance on international trade Malaysia has adopted liberal trade policies and puts a high emphasis on regional and bilateral trade agreements. CGT design generally.

Taxes to be paid include import tax and sales tax. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Paid-up capital of more than RM25 million.

GST Relief On The Importation Of Big Ticket Items. Currently cash rates are at 3 while five-year deposit rates are at 5. With global tax policy in flux companies need to be able to plan for potential changes in all the jurisdictions where they do business.

Malaysia joined the General Agreement on Trade and Tariff GATT in 1957 and was therefore a founding member of the World. Refer to Article 24 of the agreement. Malaysia adopts the self-assessment system where the taxpayer is responsible for computing ones own chargeable income and tax payable as well as making payments of any balance of tax due.

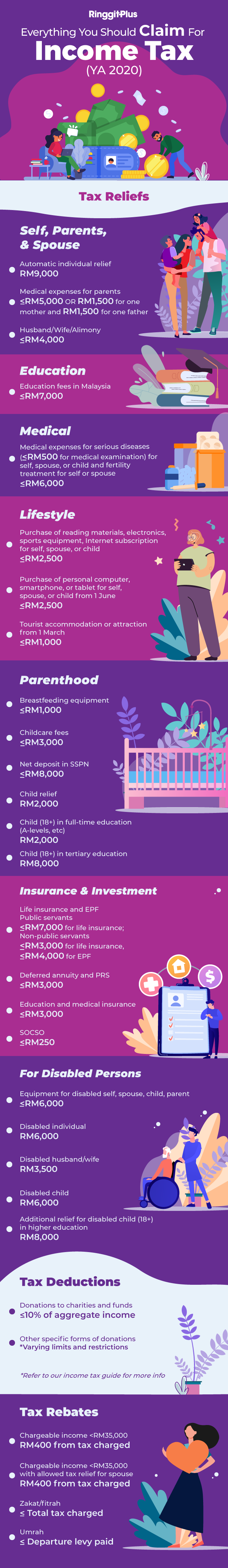

All income accrued in derived from or remitted to Malaysia is liable to tax. Tax rates of corporate tax as of Year of Assessment 2021 Paid-up capital of RM25 million or less. For the BE form resident individuals who do not carry on business the deadline for filing income tax in Malaysia is 30 April 2021.

Tax Tax controversy US tax reform Tax. Income attributable to a Labuan business. Potential negative ramifications may arise from the introduction.

Malaysia located in Southeast Asia is separated by the South China Sea into two non-contiguous regions. Goods Services Tax. 23 April 2014.

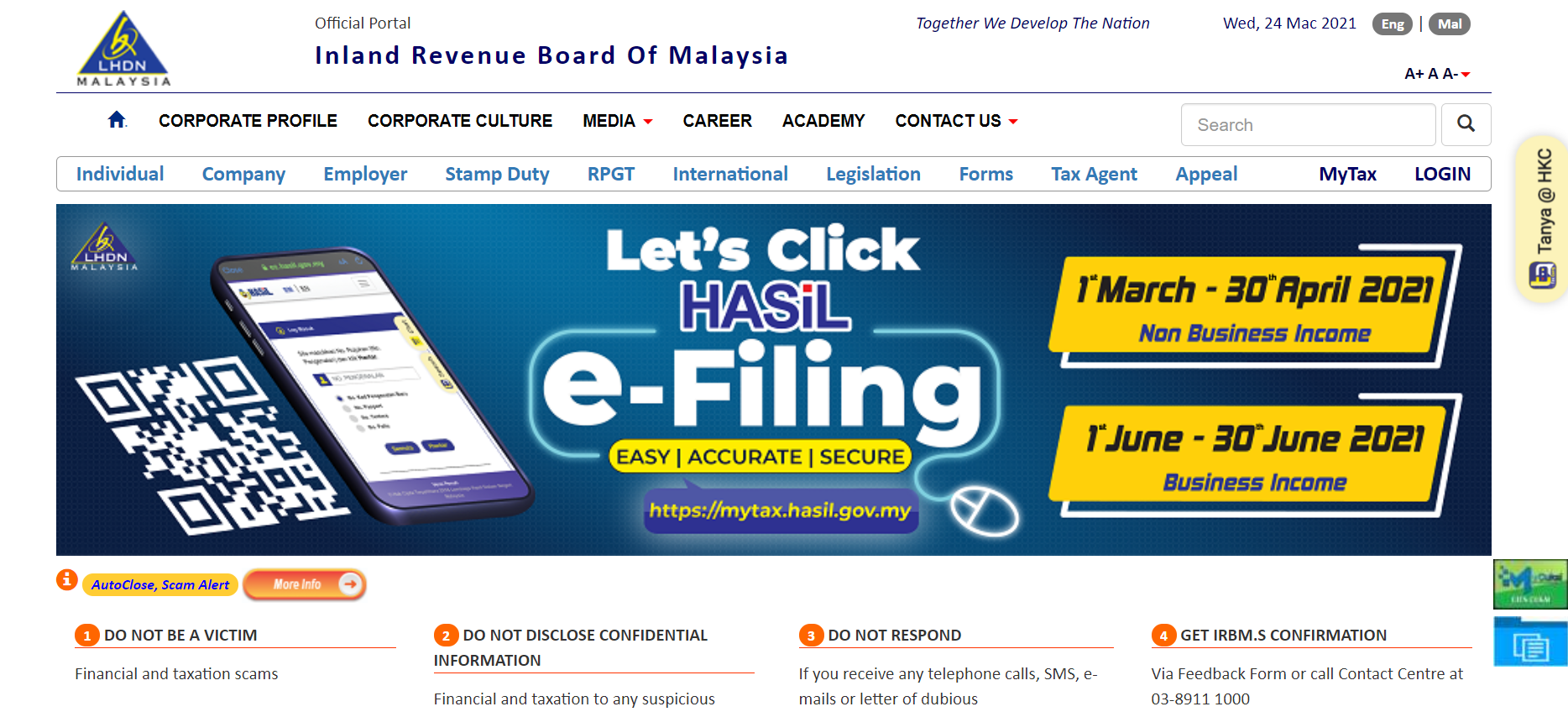

Cukai Pendapatan How To File Income Tax In Malaysia

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Malaysia Personal Income Tax Guide 2021 Ya 2020

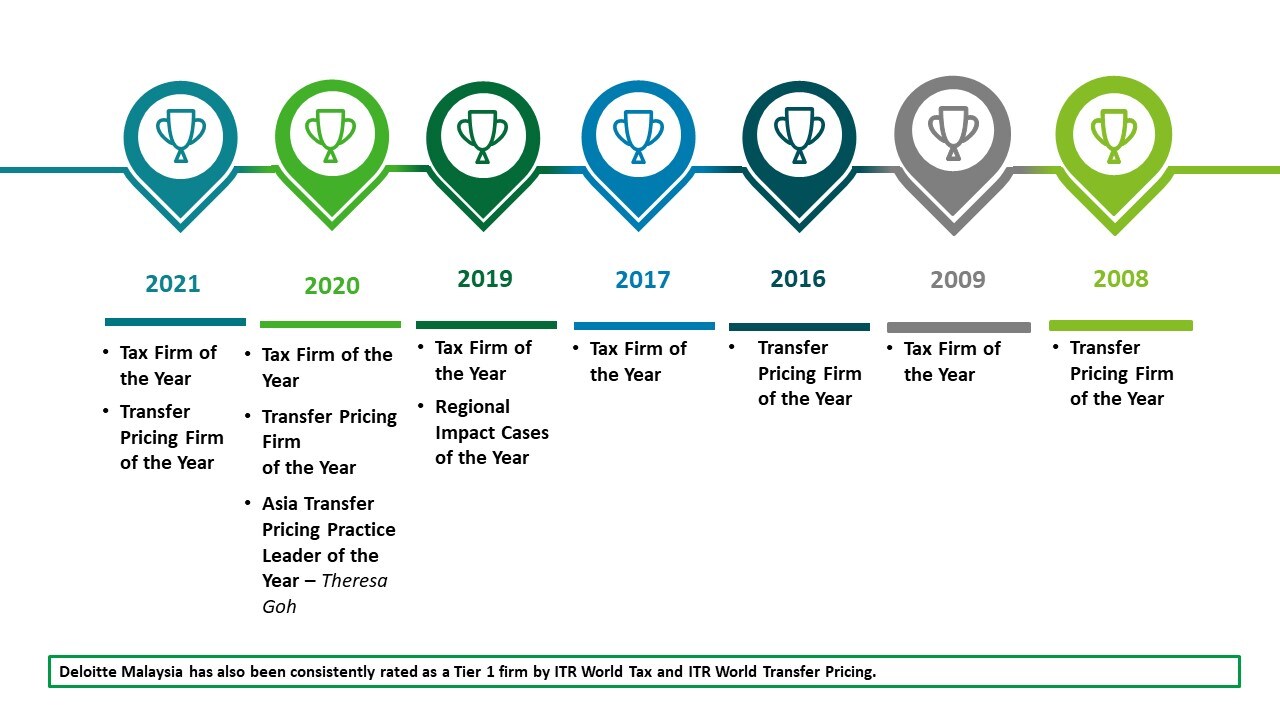

Tax Reforms Deloitte Malaysia Tax Article

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Income Tax Filing In Malaysia Income Tax Filing Taxes Income

Recognition At The Itr Asia Tax Awards 2021

Individual Income Tax In Malaysia For Expatriates

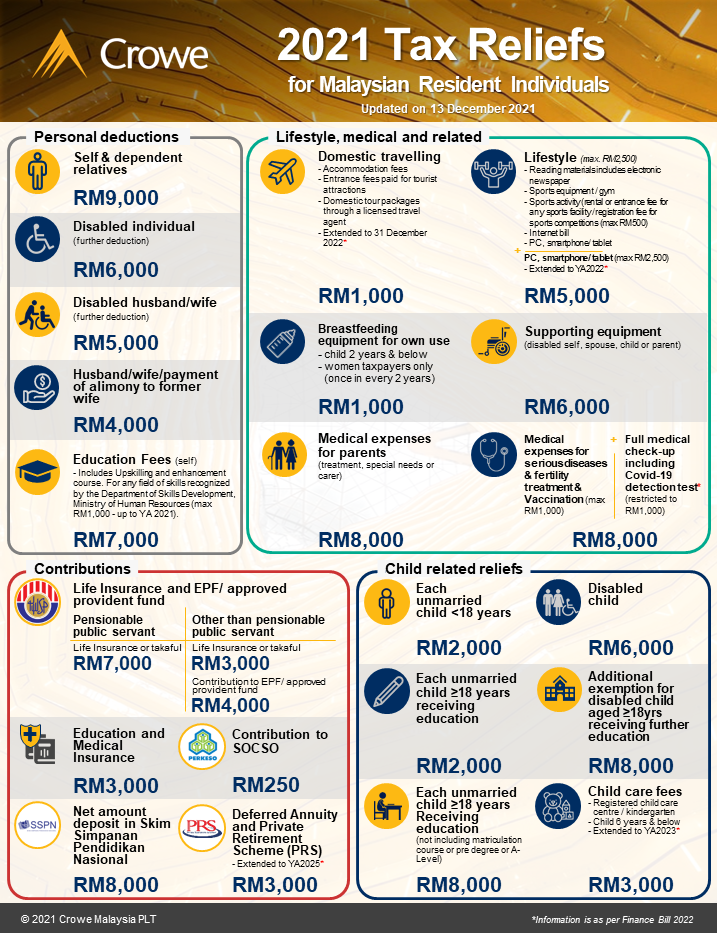

Infographic Of 2021 Tax Reliefs For Malaysian Resident Individuals Crowe Malaysia Plt

Malaysia Personal Income Tax Guide 2021 Ya 2020

Malaysia Sst Sales And Service Tax A Complete Guide

Individual Income Tax In Malaysia For Expatriates

Malaysia Personal Income Tax Guide 2021 Ya 2020

How To Step By Step Income Tax E Filing Guide Imoney

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience

Tax And Fiscal Policy In Response To The Coronavirus Crisis Strengthening Confidence And Resilience